As a customer, it is essential to understand how life insurance functions. Fortunately, some tools can help you determine how much coverage you require!

Term life insurance should be considered if you want to leave money to your loved ones after death. Life insurance may be more appropriate if you prefer to spend your savings.

Your needs and goals for financial stability will determine the optimal alternative. Before selecting insurance, knowing which policy best suits your needs is also essential.

There are two significant categories of life insurance: term life and entire life. Most people opt for the term because it is less expensive than their lives. However, they may overlook vital protections like death benefits and income protection provisions.

Whole-life insurance policies cost more because the premiums are higher, but they come with extra benefits like services for investing and regular health checks. This post will detail your choices and help you decide which one is best for you.

How Much Life Insurance Do I Need?

Finding the right coverage level can feel like determining how many towels you should have before your house gets swept away by a flood.

Finding the right coverage level can feel like determining how many towels you should have before your house gets swept away by a flood.

It’s hard to know precisely how many towels you need until after the water has dried, but in this case, that analogy applies.

You don’t want to run out of towels when a ton of wet stuff is drying off! Similarly, it can be tricky to tell how much life insurance you will need until you are exposed to something close to death.

But just as with towels, you can always use some more — especially if you run out early!

By having enough coverage, you give yourself some cushion for unexpected events. You also ensure your loved ones are taken care of in the event of your death.

Calculate Your Insurance Needs Based on Your Situation

As we mentioned before, even with adequate life insurance coverage, it can be hard to know when someone will need it.

If your spouse is in good health and plans on staying home with their children, they probably don’t require much life insurance.

On the other hand, if your spouse plans to return to the workforce or start a family later than planned, they will likely need more coverage.

It is challenging to predict what people your age will do, so instead, try calculating how important money is to yourself.

Consider whether you and your dependents could survive financially if something happened to you or them. You might want to buy more life insurance if you can’t pay your bills or save money for your children’s future without help.

Consider Your Family

As we discussed, death is a natural part of life, but it does not have to be something you look forward to. When someone unexpectedly dies in your family, it affects their friends and family physically, emotionally, and financially.

As we discussed, death is a natural part of life, but it does not have to be something you look forward to. When someone unexpectedly dies in your family, it affects their friends and family physically, emotionally, and financially.

Besides the cost of the funeral, other costs come with a death, such as:

- Loss of income at work

- Lost pension benefits

- Medical bills are paid with insurance

Other financial obligations may fall on your shoulders include credit card debt and home loans.

There are many things people do not realize about how much money they spend every day. For example, you eat two meals per day at a restaurant. Most people consider this expensive due to the food price, but they don’t include the tip or drink.

By adding up all these small expenditures, one can easily spend more than $100 weekly! To determine if you need more life insurance coverage, you need to know how much you consume daily.

Life insurance can help with some of these costs by paying for the funeral and leaving money for medical bills, household debts, and the possibility of losing a job.

This article will detail different ways to calculate the necessary life insurance.

Consider Your Health

As we have discussed, life insurance can help protect those you love in the event of death. But how much coverage you need will depend on several factors, not all of which are medically related.

One crucial factor is how healthy you are. If you are very sick or your symptoms suggest you might have a severe illness, you may need life insurance more than usual.

Another critical consideration is whether you want children. If this is your goal, investing in childcare protections could make sense.

It would help if you also considered how much money you can earn in the future. The longer you maintain that income level, the less necessary life insurance becomes!

And lastly, what kind of lifestyle do you live? Are you involved in active sports or other activities that keep you out for hours? Or does every moment seem like it’s about yourself and your career?

If so, staying within budget limits on life insurance makes sense because you’ll use the policy faster.

Consider Your Estate Plan

Photo by Tima Miroshnichenko on Pexels

Photo by Tima Miroshnichenko on Pexels

While it is crucial to understand how much life insurance you need for yourself, there are other things you should also consider.

It would be best if you considered how many children you have. If they run out of money before you die, they could be left without your parents. There are ways to address this by using savings or life insurance policies that help support dependent family members.

Also, if you own a house, think about what would happen to it if something were to happen to you. A policy can help cover the costs!

Several types of coverage are available, so you do not have to use whole-life insurance to meet your needs. Check out our article here to learn more! ”

Topic and bullet point rephrased: “Why It Is Important To Have An Estate Plan.”

This person may be a close friend or family member, but it is an honor to call anyone necessary to handle your affairs after you are gone.

With an estate plan in place, people connected to you can easily make decisions about your future health and finances. This process gives them time to prepare for whatever comes next while keeping control over their lives.

It also helps your loved ones feel less stressed because they do not have to worry about you or your situation.

Get a Life Insurance Policy

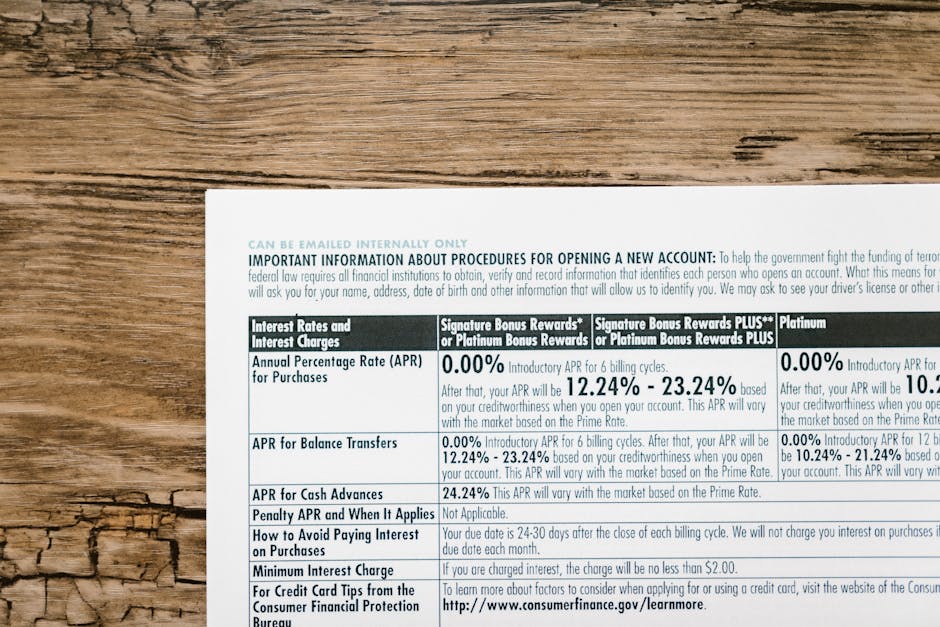

Photo by Vlad Deep on Pexels

Photo by Vlad Deep on Pexels

As we discussed, even though you are healthy now, death is inevitable for someone your age.

One person in every five will die within a year! That means there’s a good chance that something might happen to you or your family members sometime in the next twelve months.

If this sounds scary or uncomfortable for you or them, then it’s essential to consider how much money you need to leave behind for your loved ones.

Fortunately, there are ways to do this easily with our free online life insurance calculator tool. This tool will help you determine what coverage is needed so the loved ones you want to protect. It also gives you an idea of how much money you could receive as a payout.

We recommend getting at least $1,000,000 in coverage to ensure your loved ones are for no matter what happens. We don’t want anyone to have to take control of their lives because they can’t afford to pay bills or give gifts.

People wouldn’t have to worry about who gets what since everything would already be paid for. This is a great place to start, but it also depends on how much money you have and if you have children.

Write Down Your Goals.

As we mentioned earlier, personal life insurance is more than just having a lot of money in the grave to pay for final expenses. It’s also about leaving loved ones some money after you are gone.

Most people don’t think about it when they’re first looking for life insurance, but to invest well, you need enough coverage to make your financial goals come true.

For example, you might want to buy a house or invest in retirement accounts. You could also set up an educational fund or scholarship for your child. These things cost money, and none have guaranteed returns, so all those needs require adequate protection from life insurance.

And while many people feel that death benefits are the only important factor to consider when buying life insurance, this isn’t necessarily the case. For instance, how much cash you need to meet your investment goals may be just as important.

We made our life insurance calculator to help you figure out how much coverage you need to ensure you don’t run out of money before reaching your goals.

By comparing the results of different scenarios, you will know whether you need more life insurance, less life insurance, or maybe no life insurance.

Disclaimer: The information in this article is not meant to be taken as official medical advice, nor does it replace an exam or diagnosis from a doctor.